There has been a lot of deserved attention to CAUV (Current Agricultural Use Value) valuations by our membership over the past two to three years. While we have worked especially hard to represent you in Columbus, I think we should also provide the actual documents being distributed by the state of Ohio regarding CAUV.

There has been a lot of deserved attention to CAUV (Current Agricultural Use Value) valuations by our membership over the past two to three years. While we have worked especially hard to represent you in Columbus, I think we should also provide the actual documents being distributed by the state of Ohio regarding CAUV.

For those who are not farmers in Ohio, CAUV is a system for taxing farm land in Ohio that grants a property tax break to active farmers. To be eligible for CAUV:

To qualify for the CAUV, land must meet one of the following requirements during the three years preceding an application for the CAUV:

-

Ten or more acres must be devoted exclusively to commercial agricultural use; or

-

If under ten acres are devoted exclusively to commercial agricultural use, the farm must produce an average yearly gross income of at least $2,500

Why CAUV? States grant a special status to farm land to:

- keep the land in agricultural use (farmland preservation)

- help farmers account for the sometimes wild fluctuations in the markets they produce in – land is a cost of production

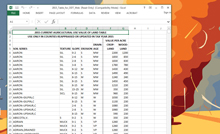

Here are the documents recently released by the Ohio Dept. of Taxation regarding CAUV:

In the counties being reassessed this year your should get a notice from your county auditor in August stating your farm’s new CAUV value. On average this year CAUV values are expected to double. This is why we continue to look for more improvements in the formula.