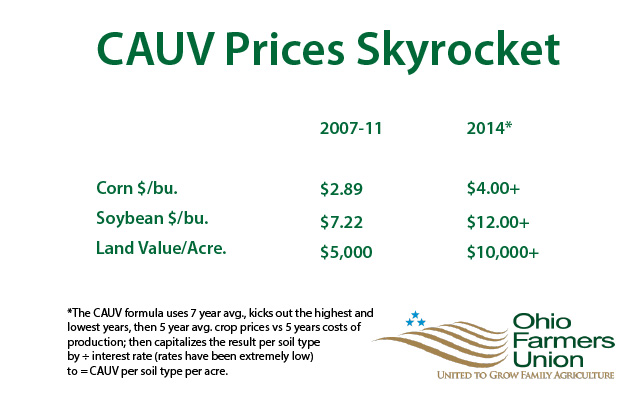

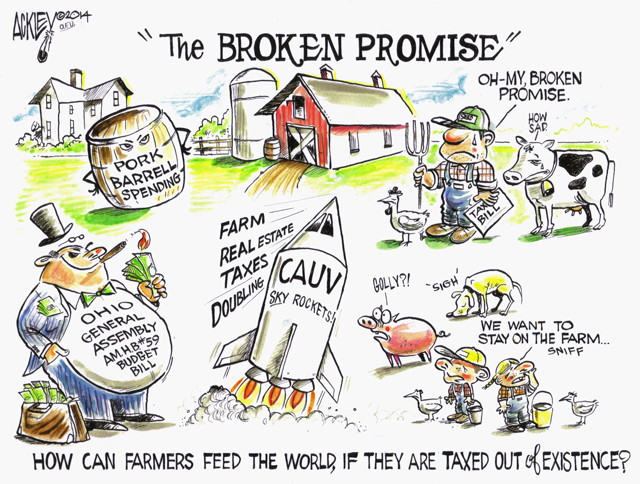

Ted Finnarn, Darke County Farmers Union Secretary-Treasurer, who is also a Greenville attorney, has been working for the past several months to educate farmers and rural landowners about skyrocketing Current Agricultural Use Value assessments for farm land property tax purposes. He’s even enlisted the help of editorial cartoonist Paul Ackley in his endeavor, as seen from the cartoon above.

Ted Finnarn, Darke County Farmers Union Secretary-Treasurer, who is also a Greenville attorney, has been working for the past several months to educate farmers and rural landowners about skyrocketing Current Agricultural Use Value assessments for farm land property tax purposes. He’s even enlisted the help of editorial cartoonist Paul Ackley in his endeavor, as seen from the cartoon above.

Check out this link for more background on the CAUV valuations issue.

Finnarn and others, working as Ohio Farmers United Against Unfair Taxation, have been circulating petitions at farmer gatherings for the past several months. The petitions have been spotted at meetings of the Ohio Farmers Union, Ohio Farm Bureau and at the recent Farm Progress Show in London, Ohio.

The petition lays out the case for what Finnarn and others believe is a broken promise made to farmers in the 1970s by current state legislators. It asks the governor and Ohio General Assembly to do three things to get CAUV valuations back in line with an agricultural landscape that is showing lower prices for commodities and increasing costs of production:

- We call on the Governor to immediately take administrative action on the CAUV to modify the formula by adopting a “Rule of Three,” 3-year averaging on any increases (or decreases) in the CAUV values, as they are implemented in the respective counties and that any increase (or decrease) to be capped at no more than 50%.

- We call on the Ohio General Assembly to reverse the action taken in the recent state budget and to restore the 10% rollback, the 2.5% residential reduction and the homestead exemption as it was before.

- As the least measure, we call for enactment of legislation that would allow real estate taxpayers that have at least a 50% increase in the real estate taxes to have a delayed payment plan option with no interest or penalty, to pay said taxes on a monthly basis to the time the next installment is due (6 months).

Please review the entire petition linked here. You may also download the petition and collect signatures in your own community. Completed petitions may be mailed to Ted Finnarn, 421 Public Square, Greenville, Ohio 45331.