by Dr. Tony Forshey, State Veterinarian, Ohio Dept. of Agriculture

by Dr. Tony Forshey, State Veterinarian, Ohio Dept. of Agriculture

Summer marks the beginning of fair season – a time when thousands of 4-H youth all across the state showcase the animal projects they have spent so much time perfecting.

As these hard working kids gear up to show their animals, I want to encourage all exhibitors to be aware of livestock tampering rules so they do not accidentally disqualify their market animal projects.

Some key things to keep in mind as you prepare your animal for the show ring:

- If an animal is sick, the exhibitor should contact the veterinarian.

- Prescription medications must be prescribed by a veterinarian for a valid medical purpose.

- Extra-label use of any medication must be prescribed by a veterinarian and have an extended withdrawal time.

- Over-the-counter drugs must be used according to label directions for a valid medical purpose.

- Showing any livestock which has been administered a drug that exceeds the tolerance level, or a drug for which the withdrawal period has not elapsed, is prohibited.

Other prohibited practices include: exhibiting an animal which has been tranquilized, making a false statement on a drug use notification form, failing to file or update a drug use notification form, negligently causing an unlawful substance to be present in an animal, or failing to sign a chain of custody form.

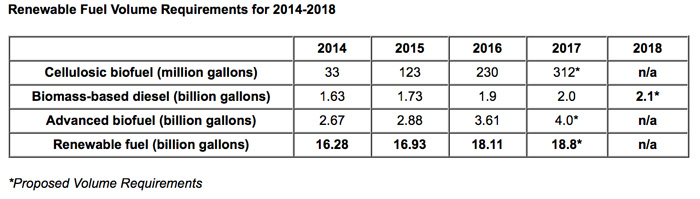

U.S. EPA released the 2017 proposed renewable fuel volumes under the Renewable Fuel Standard and according to the National Farmers Union, they continue to fall short of congressionally mandated levels.

U.S. EPA released the 2017 proposed renewable fuel volumes under the Renewable Fuel Standard and according to the National Farmers Union, they continue to fall short of congressionally mandated levels.

The Ohio Farmers Union, working through Darke County attorney Ted Finnarn – an OFU member and a member of the Ohio Dept. of Taxation’s CAUV Advisory panel – has been doggedly working for the past three years to get Columbus to fix the problems with Current Agricultural Use Valuations (CAUV).

The Ohio Farmers Union, working through Darke County attorney Ted Finnarn – an OFU member and a member of the Ohio Dept. of Taxation’s CAUV Advisory panel – has been doggedly working for the past three years to get Columbus to fix the problems with Current Agricultural Use Valuations (CAUV).