Serious Abuses of Ohio Beef Checkoff Tax Dollars Show Need for Reform

Today, the Organization for Competitive Markets and Ohio Farmers Union released a briefing paper outlining how federal and state funds are being used to prop up and fund a trade and lobbying entity. The Ohio Beef Council, an agency of the Ohio Department of Agriculture, is funneling taxpayer dollars through payroll expenses and rental costs to fund the trade and lobbying group, Ohio Cattlemen’s Association. Further, the state agency raises funds for the Ohio Cattlemen’s Association Political Action Committee (PAC) to influence elections and legislation. It also makes annual cash payments of at least $14,000 per year to the national trade and lobbying group, National Cattlemen’s Beef Association. As set out in the new briefing paper, the state-supported funding is in violation of both state and federal law.

Today, the Organization for Competitive Markets and Ohio Farmers Union released a briefing paper outlining how federal and state funds are being used to prop up and fund a trade and lobbying entity. The Ohio Beef Council, an agency of the Ohio Department of Agriculture, is funneling taxpayer dollars through payroll expenses and rental costs to fund the trade and lobbying group, Ohio Cattlemen’s Association. Further, the state agency raises funds for the Ohio Cattlemen’s Association Political Action Committee (PAC) to influence elections and legislation. It also makes annual cash payments of at least $14,000 per year to the national trade and lobbying group, National Cattlemen’s Beef Association. As set out in the new briefing paper, the state-supported funding is in violation of both state and federal law.

Joe Logan, President of Ohio Farmers Union, said, “For years we have shared these concerns, but they have only fallen on deaf ears at the Ohio Department of Agriculture. Last month at our Ohio Farmers Union convention, we passed a resolution to put a stop to these taxpayer abuses. We can only hope, based on the evidence in the briefing paper, others in our government will hear the cry of Ohio’s cattle producers and answer the call to clean up this mess.”

Joe Maxwell, Executive Director of Organization for Competitive Markets, said, “It is just unimaginable that the state of Ohio is allowing this taxpayer abuse. A large portion of these funds are federal tax dollars collected by this state agency. The state has a responsibility to administer these federally mandated funds, no differently than it does any other federal funds it receives. Ohio’s family farmers deserve no less.”

The new briefing paper outlines the following taxpayer abuses and seeks the following government action:

Abuses

- Department of Agriculture agency Ohio Beef Council employees go to work every day for the Ohio Cattlemen’s Association, a state trade and lobbying organization.

- State and federal funds are offsetting the organizational overhead costs for the Ohio Cattlemen’s Association.

- The Ohio Beef Council promotes and collects donations for the Ohio Cattlemen’s Association’s Political Action Committee (PAC).

- State and federal funds are being directly contributed to the National Cattlemen’s Beef Association, a national trade and lobbying organization.

- The only reports available to the cattle producers who pay the mandatory fees are self-reports by the Ohio Beef Council. There is a lack of taxpayer transparency on how the checkoff funds are being expended.

- The state and federal checkoff funds are not appropriated by the legislature nor audited by the state auditor, leaving little if any government oversight of the mandatory checkoff fees.

Recommended Actions

- Federal and state checkoff funds should be paid directly to the appropriate federal or state treasury and then be audited by the corresponding federal or state auditing agency.

- The Ohio Department of Agriculture should immediately segregate all activity between the Ohio Beef Council and the Ohio Cattlemen’s Association. Policy should be established that clearly outlines:

- No state employee should report to a lobbying entity office for work.

- No state or federal funds should be used directly or indirectly to offset a lobbying entity’s overhead costs to include office rent, equipment costs, salaries or any incidental costs incurred by the lobbying entity.

- All government funds should be expended pursuant to state standard contracting processes.

As farming communities face mounting challenges with the nation’s opioid epidemic, the nation’s two largest general farm organizations are teaming up to confront the issue. The American Farm Bureau Federation (AFBF) and National Farmers Union (NFU) announced a new campaign, “Farm Town Strong,” to raise awareness of the crisis’ impact on farming communities. The campaign will also provide resources and information to help farm communities and encourage farmer-to-farmer support to overcome the crisis.

As farming communities face mounting challenges with the nation’s opioid epidemic, the nation’s two largest general farm organizations are teaming up to confront the issue. The American Farm Bureau Federation (AFBF) and National Farmers Union (NFU) announced a new campaign, “Farm Town Strong,” to raise awareness of the crisis’ impact on farming communities. The campaign will also provide resources and information to help farm communities and encourage farmer-to-farmer support to overcome the crisis. Program Shaping Up – More to Announce in January

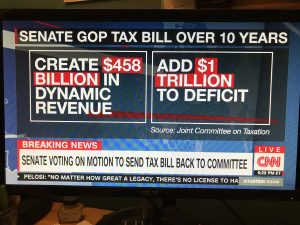

Program Shaping Up – More to Announce in January As the U.S. Congress readies to vote on a major overhaul of the nation’s tax system, National Farmers Union and Ohio Farmers Union are urging lawmakers to vote against the current plan because of its regressive structure and devastating implications for the nation’s financial standing, farm program spending, and health care affordability for family farmers and ranchers.

As the U.S. Congress readies to vote on a major overhaul of the nation’s tax system, National Farmers Union and Ohio Farmers Union are urging lawmakers to vote against the current plan because of its regressive structure and devastating implications for the nation’s financial standing, farm program spending, and health care affordability for family farmers and ranchers. The 2018 Joseph Fichter Scholarship will be awarded in late January – OFU high school seniors should apply now.

The 2018 Joseph Fichter Scholarship will be awarded in late January – OFU high school seniors should apply now. Thanks to the Ohio Dept. of Agriculture for publishing a list this week with dates for all of Ohio’s county fairs for 2018. The first fair will be held in Paulding County on June 11, 2018 and the final fair of the season will begin October 13, 2018 in Fairfield County.

Thanks to the Ohio Dept. of Agriculture for publishing a list this week with dates for all of Ohio’s county fairs for 2018. The first fair will be held in Paulding County on June 11, 2018 and the final fair of the season will begin October 13, 2018 in Fairfield County. from National Farmers Union

from National Farmers Union COLUMBUS – The Ohio Farmers Union today called on U.S. Sen. Rob Portman to vote ‘no’ on the major tax bill pending in the upper body of Congress.

COLUMBUS – The Ohio Farmers Union today called on U.S. Sen. Rob Portman to vote ‘no’ on the major tax bill pending in the upper body of Congress. Farmers and ranchers take home just 11.4 cents from every dollar that consumers spend on their Thanksgiving dinner meals, according to the annual Thanksgiving edition of the National Farmers Union (NFU) Farmer’s Share publication. The popular Thanksgiving Farmer’s Share compares the retail food price of traditional holiday dinner items to the amount the farmer receives for each item they grow or raise.

Farmers and ranchers take home just 11.4 cents from every dollar that consumers spend on their Thanksgiving dinner meals, according to the annual Thanksgiving edition of the National Farmers Union (NFU) Farmer’s Share publication. The popular Thanksgiving Farmer’s Share compares the retail food price of traditional holiday dinner items to the amount the farmer receives for each item they grow or raise.