NFU: Concerns Linger Over Farm Credit

Johnson Expresses Ongoing Concern in U.S. Senate

The Senate Agriculture Committee yesterday examined the current state of affairs at a hearing about the Farm Credit System (FCS) and the farm sector’s credit outlook.

National Farmers Union President Roger Johnson applauded committee members for making this issue a priority. (Check out our recent post on this issue describing some of the problems.)

“The multi-year trend of low commodity prices coupled with higher input costs is becoming ever more challenging for producers,” he said. “Unfortunately, we are seeing this manifest in weakening credit conditions as it relates to loan repayment rates and lenders restructuring debt to manage credit risk.”

Many producers have already tapped capital from prosperous years and now find themselves with liquidity challenges, he explained. If low commodity prices persist, debt restructuring of operating and equipment costs from short-term to medium and long-term debt may present a real challenge for the farm credit sector.

The hearing featured two panels of witnesses that included the Farm Credit Administration Board, Farm Credit Services of America & Frontier Farm Credit of Omaha, community bankers from Iowa and Kansas, and one producer.

In conjunction with the hearing, NFU joined more than 50 agriculture groups signing a letter in support of FCS and other creditors and the critical role ag lending institutions play in ensuring farmers, ranchers and rural Americans have continued access to competitive credit. NFU independently submitted a statement for the hearing record.

OFU Insurance Now Offers MedSupp with Silver Sneakers!

Ohio Farmers Union members save on health insurance and now we offer a Medicare Supplement plan for people aged 65 and over that comes with Silver Sneakers – at no additional cost. Dave Shindollar tells me the Silver Sneakers program is a $500 annual value to you via Medical Mutual and your local YMCA.

Open enrollment applies – no medical questions – call Dave Shindollar at (800) 321-3671 or email him dshindollar@ohfarmersunion.org for prices and more information.

Vigilance Needed for U.S. Farm Economy

The Federal Reserve Bank of Kansas City said in late April that farm lending is robust and concluded in a report that, “Agricultural credit conditions deteriorated somewhat as repayment rates declined and delinquency rates picked up slightly alongside reduced farm income.”

The Federal Reserve Bank of Kansas City said in late April that farm lending is robust and concluded in a report that, “Agricultural credit conditions deteriorated somewhat as repayment rates declined and delinquency rates picked up slightly alongside reduced farm income.”

In short, lower commodity prices, higher input prices and (in Ohio) higher taxes are having effects on farm credit – and therefore farm income.

“Farmers and ranchers are facing serious hardships as they deal with the financial challenges associated with the lean times we are in. The Federal Reserve’s assessment of farm credit conditions, with signs of deterioration and more challenging loan renewals has NFU very concerned about the hard times ahead,” said Roger Johnson, president of NFU.

There are twelve Federal Reserve Banks in the U.S. Each one is responsible for a portion of the country. Ohio’s Federal Reserve Bank is in Cleveland. Along with their regular duties, each of the banks also contributes to the nation’s economic data and research. The Kansas City bank covers regional issues like agricultural economics.

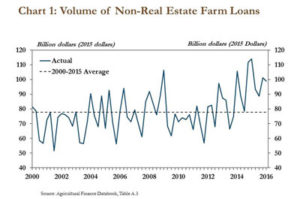

The K.C. Fed said non-real estate loans declined slightly so far in 2016, but the overall loan rate is higher.

“Producers, cash-strapped by persistently high input costs and low commodity prices, may experience trouble accessing credit, negative farm budgets and depressed markets if the trends continue as forecasted by the U.S. Department of Agriculture,” he explained to members of the committee.

Johnson pointed to the Farm Service Agency (FSA) loan portfolio as an indicator to measure the health of the farm sector. FSA loan demand is up 21 percent over the same time last year with $3.4 billion of the $6.47 billion in lending authority for fiscal year 2016 being utilized. The findings of the report expand on the narrative of the multitude of challenges faced by farmers and ranchers.

Large operating loans accounted for a significant share of the total loan volume growth, which could be due to the persistently high input costs and farm expansion, the report says. In addition, loan delinquency rates increased slightly and repayment rates declined; though, rates are still below the 15-year average.

Reduced cash flow and short-term liquidity problems have lenders seeking to restructure existing loans, leading to an increased demand for loan renewals and extensions, the report found. Banks reported slight increases to interest rates for higher-risk borrowers in an attempt to reduce their risk.

“The 1980’s constantly looms over us, and while conditions are different, today we must remain vigilant and provide support as we face a situation that is trending negative,” Johnson concluded.

Help Change CAUV – Sign & Circulate the Petition

The Ohio Farmers Union, working through Darke County attorney Ted Finnarn – an OFU member and a member of the Ohio Dept. of Taxation’s CAUV Advisory panel – has been doggedly working for the past three years to get Columbus to fix the problems with Current Agricultural Use Valuations (CAUV).

The Ohio Farmers Union, working through Darke County attorney Ted Finnarn – an OFU member and a member of the Ohio Dept. of Taxation’s CAUV Advisory panel – has been doggedly working for the past three years to get Columbus to fix the problems with Current Agricultural Use Valuations (CAUV).

Part of this effort is a petition drive, spearheaded by Finnarn, and directed at OFU and other farm organizations across the state. Finnarn works for OFU but also attends meetings of the Ohio Farm Bureau Federation and other groups educating and advocating regarding CAUV reform. He circulates the petition, linked below, across the state.

Here’s what you can do.

Download and print the petition. Sign and it and ask your friends and family in rural Ohio to also sign. Once a page is filled out, please send the page via U.S. mail to Farmers Union, c/o 421 Public Square, Greenville, Ohio 45331.

Next CAUV Meeting April 22 in Spencer

Family farm group wants end to skyrocketing farmland tax rate

The Ohio Farmers Union will continue its educational campaign on the causes and solutions to rural Ohio’s skyrocketing property taxes.

The Ohio Farmers Union will continue its educational campaign on the causes and solutions to rural Ohio’s skyrocketing property taxes.

Farmland, woodland and conservation acres owners in Ohio have seen 50 to 300 percent tax increases since 2009 due to problems with the state’s CAUV formula.

CAUV – or current agricultural use valuation – is the complex formula used to determine tax values for agricultural land in Ohio. Since the Great Recession, anomalies in grain markets and historically low Federal Reserve interest rates have put CAUV out of balance.

“CAUV worked for Ohio family farmers well for more than three decades,” said Ohio Farmers Union President Joe Logan, “But, a perfect storm of recent events has thrown it off-track.”

“While farmers do expect their CAUV values to increase from time to time, it’s been quite a shock to the system for many self-employed farmers to see double and triple digit property tax increases. Many farmers around the state have now been through two of these increase cycles and it’s an unfair and unreasonable burden on Ohio’s farmers,” Logan added.

OFU and nearly all other farm groups in the state are advocating for some minor changes to the formula contained in two bills pending the Ohio General Assembly, HB 398 and SB 246. As part of their advocacy, OFU is sponsoring informational sessions around Ohio. The first was held in northwest Ohio in early April.

The next meeting will be held Friday, April 22, 1:00 p.m. at the Risley Agricultural Center, 5220 Root Road, Spencer, Ohio. The featured speaker will be Darke County attorney Ted Finnarn who is the OFU representative on the agricultural advisory board that provides information and ideas to the Ohio Dept. of Taxation. Finnarn has served in that capacity since the board’s inception in 1976. Finnarn is an OFU member and also works with the Ohio Farm Bureau Federation on CAUV.

NFU’s Johnson Testifies on Capitol Hill

The lagging farm economy was a top focus today for the House Agriculture Subcommittee on General Farm Commodities and Risk Management. National Farmers Union (NFU) President Roger Johnson joined a panel of industry leaders to testify on behalf of NFU’s nearly 200,000 members who are currently facing a diverse set of challenges in the farm sector.

The lagging farm economy was a top focus today for the House Agriculture Subcommittee on General Farm Commodities and Risk Management. National Farmers Union (NFU) President Roger Johnson joined a panel of industry leaders to testify on behalf of NFU’s nearly 200,000 members who are currently facing a diverse set of challenges in the farm sector.

“As commodity prices continue to decline and farmers and ranchers struggle to adjust to lower prices, there is a growing burden felt by producers out in the countryside,” Johnson informed members of the committee. “Even more worrisome is the U.S. Department of Agriculture forecasts, which show a prolonged period of low commodity prices. This situation will result in trouble accessing credit, negative farm budgets, depressed markets and tests to the farm safety net.”

The downturned farm economy has put a significant strain on farm financials, Johnson explained. “We are seeing this manifest itself in the Farm Service Agency’s loan portfolio, an early indication of challenges ahead,” he said.

Help NFU Set Priorities for Next Farm Bill – Take the Survey

With the 2014 Agricultural Act in full effect and a new Farm Bill debate on the horizon, the National Farmers Union is conducting a survey of family farmers and ranchers across the country to gain a greater understanding of the effectiveness of these programs.

With the 2014 Agricultural Act in full effect and a new Farm Bill debate on the horizon, the National Farmers Union is conducting a survey of family farmers and ranchers across the country to gain a greater understanding of the effectiveness of these programs.

“As a farmer-led organization, we work closely with our diverse membership to advocate for policies that support family farmers and ranchers and the communities where they live,” explained NFU President Roger Johnson. “After the review, we will be able to better gauge the effectiveness of current farm policies and identify our advocacy priorities for the next Farm Bill process.”

The survey, announced earlier this month at the 114th Anniversary Convention in Minneapolis, Minn., is meant to complement the feedback gained through a simultaneous series of member listening sessions held across the country.

The survey will remain open through July 31, 2016, after which time responses will be collected and analyzed by NFU staff to establish policy proposals and engage partners for the upcoming Farm Bill debate.

“An educated and vocal membership is one of the things that makes NFU such a strong grassroots organization,” Johnson concluded. “We need to hear from a large number of our members to make sure the farm bill addresses the most serious challenges, including climate change and market consolidation, facing rural America today.”

Farmers and ranchers are invited to complete the NFU Farm Bill survey here.

NFU Beginning Farmer Institute Accepting Applications for 2016-17 Class

Cultivating the next generation of farmers and ranchers to carry on the legacy of American agriculture is the main focus of the National Farmers Union Beginning Farmer Institute.

Cultivating the next generation of farmers and ranchers to carry on the legacy of American agriculture is the main focus of the National Farmers Union Beginning Farmer Institute.

NFU encourages new farmers, starting an operation of any size, to apply for the 2016-17 program class.

Through sessions hosted in Washington D.C. and California, the program’s hands-on training emphasizes many of the challenges beginning farmers may face in their careers, such as business planning, access to capital, land acquisition, marketing, and more.

“As the farm population continues to age, we are looking to the next generation of farmers and ranchers to continue to produce food, fiber and fuel. But farming can be an overwhelming business to get started if you don’t have the right tools,” said NFU president Roger Johnson. “For more than five years, the Beginning Farmer Institute has empowered new farmers from across the country to operate successful farm businesses.”

Farmers from all geographic regions and a diverse range of production methods have greatly benefitted from the training. The most recent graduates of the program, who were recognized at the NFU Convention in Minneapolis, Minn., earlier this month, represented seven states. Women and veterans have been among the program’s most active participants.

“More than half the participants have been women and nearly 10 percent have been veterans,” explained Johnson. “I am pleased to see the diversity of skills and backgrounds these beginning farmers are bringing to the industry.”

Applications for the 2016-2017 class must be postmarked by April 30, 2016, and the class roster will be announced on June 10, 2016. More information about the NFU Beginning Farmer Institute is available at here.

USDA Ups the Ante on a Cleaner Lake Erie

The USDA announced on Monday that the federal agency is upping its previous $36-million-dollar investment in Lake Erie water quality by a further $41 million.

The USDA announced on Monday that the federal agency is upping its previous $36-million-dollar investment in Lake Erie water quality by a further $41 million.

The previous dollars were part of the 2014 Farm Bill. This new money brings the total federal investment in various conservation programs to $77 million. The funds are part of a three-year plan to help clean up the lake and improve nutrient management and conservation practices in NW Ohio.

“The challenges that face Lake Erie require science-based solutions and a commitment from all partners to address the factors that impact water quality. The area’s farmers and ranchers have already made great strides in helping to reduce runoff, and with this new investment they will be able to do even more,” said USDA Secretary Tom Vilsack. “Farmers and landowners will be able to add conservation measures to about 870,000 acres in this critical watershed, effectively doubling the acres of conservation treatment that can be accomplished in the three years.”

Natural Resources Conservation Service Chief Jason Weller unveiled a new initiative in Toledo on Monday that will run through 2018 and contains the new investment.

Also on Monday, Weller released a report from the Conservation Effects Assessment Project that showed voluntary conservation measures have made a difference in reducing nutrient and soil runoff from farms in the western Lake Erie basin.

Weller said that while gains have been made, there is still opportunity for improvement in NW Ohio, Indiana and Michigan and the new initiative and funding could make a difference in reducing Lake Erie’s plague of annual harmful algae blooms.

According to the CEAP report, this initiative will help landowners reduce phosphorus runoff from farms by more than 640,000 pounds each year and reduce sediment loss by over 260,000 tons over the course of the three-year investment.

“Throughout the basin, comprehensive field-scale conservation planning and conservation systems are needed to accommodate different treatment needs while maintaining productivity,” said Weller. “While voluntary conservation is making a difference in the basin, the CEAP evaluation tells us that there are still gains that can be made through an emphasis on practices like precision agriculture.”

Ohio Farmers Union Joe Logan attended the NRCS event in Toledo and said, “This is a big deal for western Lake Erie and in terms of the commitment USDA has shown agriculture in Ohio, Indiana and Michigan.”