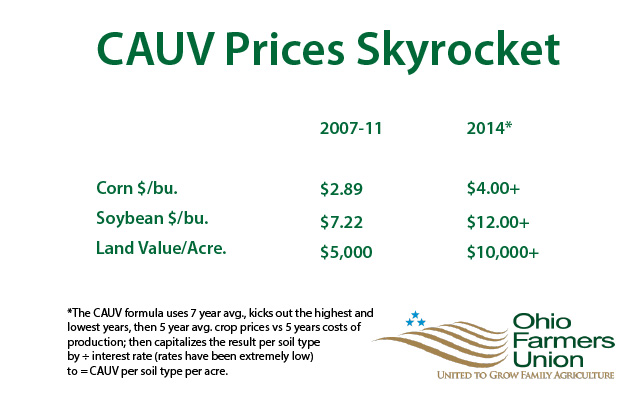

Farmers across Ohio have benefited in the past in regards to CAUV values that have been kept extremely low and now these values are scheduled to increase quite a bit in the next few years.

Farmers across Ohio have benefited in the past in regards to CAUV values that have been kept extremely low and now these values are scheduled to increase quite a bit in the next few years.

Ted Finnarn, Darke County attorney, is the Ohio Farmers Union representative to the Agricultural Advisory Committee of the Division of Tax Equalization and this CAUV Advisory Committee functions to advise the Ohio Department of Taxation on the operation of the Current Agricultural Use Valuation (CAUV) law and the consequent valuations used under the law.

Finnarn has served on this State Committee for over 38 years originally being appointed by the Ohio Farmers Union in 1976. Scott Zumbrink, Darke County Treasurer, has also served on the committee, representing the State Treasurers’ Association since 2007.

According to Finnarn and Zumbrink, the CAUV table valuations (which vary according to soil type, slope, drainage and soil management groups, using inputs of a 5-year “olympic” average of crop prices and costs of production) will increase substantially for tax year 2014 effective for taxes to be paid in 2015. When the more important comparison is made between the 2011 table valuations to the 2014 valuations (the 2011 table being the last one used by counties, which will now use the 2014 values, due to the 3 year rotation), farmers may see increases of approximately 110-185% or more in CAUV values.